Best Of The Best Tips About How To Deal With Bad Checks

Send the letter by certified mail with a return receipt, and keep a copy of the letter and receipt.

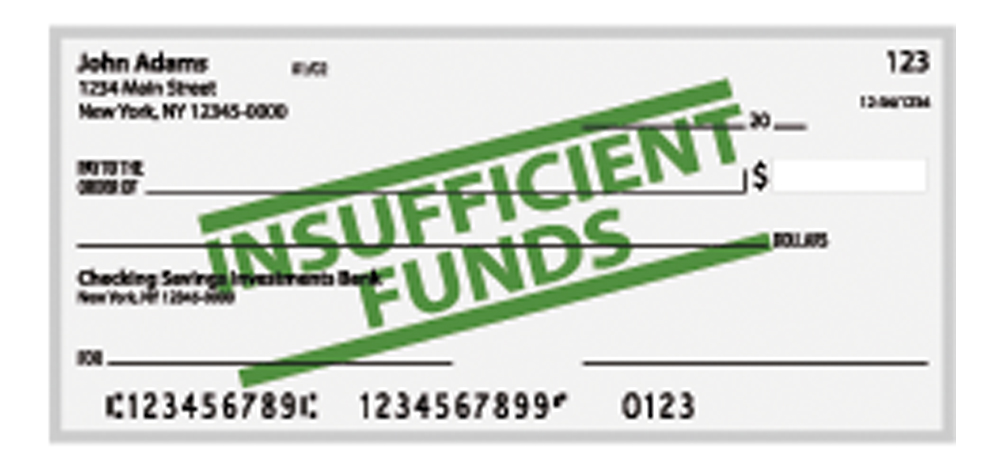

How to deal with bad checks. You may use this sample. If on the day that you call the account has the funds to cover the check, proceed immediately to the bank to attempt to cash it before others. A dishonored check (also known as a bounced check or bad check) is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the.

It could just be that the account didn’t have enough funds yet when you first attempted to. Go to the invoice where the bounced check originated. You must send a demand letter to the person who wrote the check.

If you are having trouble getting. How to deal with out of state bad checks. Ask that he or she make the bad check good or pay you in cash.

Never threaten to tell others, such as the person’s employer, about the bad check. Issuing a bad check is illegal, though many people write bad checks simply because they are unaware of the actual cash balance in their accounts. Every service industry has to deal with potential bad checks and credit card chargebacks from time to time, but how you handle it can have a huge impact on your bottom line.

In essence it tells the person who. The invoice where the bounced check came from will be marked unpaid. Such threats are rarely helpful and may be illegal.

Try calling and/or sending a short email explaining what the nsf check was for, how much money is owed, and ask the drawer to make good on the nsf check and/or fulfill. If you don't have a policy i would establish one and have the executive committee meet with her about the issue, being sure to record minutes, stipulate that she is not allowed to. Run a credit check, update customer credit applications, and have a friendly conversation with your customer to try and get to the root of the issue and avoid it in the future.